PV Co is evaluating an investment proposal to manufacture Product W33, which has performed well in test marketing trials conducted recently by the company’s research and development division. The following information relating to this investment proposal has now been prepared.

Initial investment $2 million

Selling price (current price terms) $20 per unit

E.xpected selling price inflation 3% per year

Variable operating costs (current price terms) $8 per unit

F.ixed operating costs (current price terms) $170,000 per year

E.xpected operating cost inflation 4% per year

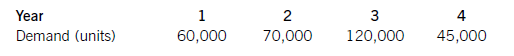

The research and development division has prepared the following demand forecast as a result of its test marketing trials. The forecast reflects expected technological change and its effect on the anticipated life-cycle of Product W33.

It is expected that all units of Product W33 produced will be sold, in line with the company’s policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product W33 is planned to end. For investment appraisal purposes, PV Co uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 30% per year. Ignore taxation.

Required:(a) Identify and explain the key stages in the capital investment decision-making process, and the role of

investment appraisal in this process. (7 marks)(b) Calculate the following values for the investment proposal:(i) net present value;(ii) internal rate of return;(iii) return on capital employed (accounting rate of return) based on average investment; and(iv) discounted payback period. (13 marks)(c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. (5 marks)

参考答案与解析:

-

相关试题

-

The internal rate of return (IRR) method of evaluating investment projects:

-

[单选题]The internal rate of return (IRR) method of evaluating investment projects:

- 查看答案

-

A company is evaluating the following investment proposals that have the same risk as the company:&l

-

[单选题]A company is evaluating the following investment proposals that have the sa

- 查看答案

-

An analyst of a company is evaluating the following investment proposals A, B, C that have the same

-

[单选题]An analyst of a company is evaluating the following investment proposals A,

- 查看答案

-

A company is evaluating an independent investment project that has the same risk as the company. If

-

[单选题]A company is evaluating an independent investment project that has the same

- 查看答案

-

An analyst is evaluating an investment in an apartment complex based on the following annual data:&l

-

[单选题]An analyst is evaluating an investment in an apartment complex based on the

- 查看答案

-

An analyst does research about capital investment project. A company is evaluating a capital investm

-

[单选题]An analyst does research about capital investment project. A company is eva

- 查看答案

-

An investor evaluating a company's common stock for investment has gathered the following data.

-

[单选题]An investor evaluating a company's common stock for investment has gathered

- 查看答案

-

But in the end he approved of our propos

-

[单选题]B.ut in the end he approved of our proposal.A.undoubtedlyB.certainlyC.ultimatelyD.necessarily

- 查看答案

-

Neiman Investment Co. receives brokerage business from Pick Asset Management in exchange for referri

-

[单选题]Neiman Investment Co. receives brokerage business from Pick Asset Managemen

- 查看答案

-

An analyst is investigating an investment project of Hellet Corporation. The investment project with

-

[单选题]An analyst is investigating an investment project of Hellet Corporation. Th

- 查看答案