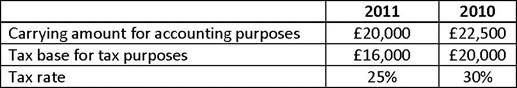

A company purchased equipment in 2010 for £25,000. The year-end values of the equipment for accounting purposes and tax purposes are as follows:

Which of the following statements best describes the effect of the change in the tax rate on the company's 2011 financial statements? The deferred tax liability:

A.Increases by £250.

B.Decreases by £200.

C.Decreases by £800.

参考答案与解析:

-

相关试题

-

A company purchased equipment for $50,000 on 1 January 2009. It is depreciating the equipment over a

-

[单选题]A company purchased equipment for $50,000 on 1 January 2009. It is deprecia

- 查看答案

-

At the beginning of the year, Triple W Corporation purchased a new piece of equipment to be used in

-

[单选题]At the beginning of the year, Triple W Corporation purchased a new piece of

- 查看答案

-

A company recently purchased a warehouse property and related equipment (shelving, forklifts, etc.)

-

[单选题]A company recently purchased a warehouse property and related equipment (sh

- 查看答案

-

A company purchased equipment for $50,000 on 1 January 201 It is depreciating the equipmentover a pe

-

[单选题]A company purchased equipment for $50,000 on 1 January 201 It is depreciati

- 查看答案

-

A company purchased a new equipment oven directly from Italy for $13,289. It will work for 5 years a

-

[单选题]A company purchased a new equipment oven directly from Italy for $13,289. I

- 查看答案

-

At the stag of the year, a company acquired new equipment at a cost of €50,000, estimated to have a

-

[单选题]At the stag of the year, a company acquired new equipment at a cost of €50,

- 查看答案

-

At the start of the year, a company acquired new equipment at a cost of €50,000, estimated to have a

-

[单选题]At the start of the year, a company acquired new equipment at a cost of €50

- 查看答案

-

East Company purchased a new truck a t the beginning of this year for $30,000. The truck has a usefu

-

[单选题]East Company purchased a new truck a t the beginning of this year for $30,0

- 查看答案

-

Two years ago, Metcalf Corp. purchased machinery for $800,000. At the end of last year, the machiner

-

[单选题]Two years ago, Metcalf Corp. purchased machinery for $800,000. At the end o

- 查看答案

-

Year-end bonus will be( )according to individual contribution.

-

[单选题]Year-end bonus will be( )according to individual contribution.A.detachedB.a

- 查看答案