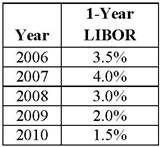

A 5-year floating-rate security was issued on January 1, 2006. The coupon rate formula was 1-year LIBOR + 300 bps with a cap of 10% and a floor of 5% and annual reset. The 1-year LIBOR rate on January 1st of each year of the security's life is provided in the following table:

During 2010, the payments owed by the issuer were based on a coupon rate closest to:

A.4.5%.

B.5.0%

C.6.5%.

参考答案与解析:

-

相关试题

-

The current 4-year spot rate is 4% and the current 5-year spot rate is 5.5%. What is the 1-year forw

-

[单选题]The current 4-year spot rate is 4% and the current 5-year spot rate is 5.5%

- 查看答案

-

For a 10-year floating-rate security, if market interest rates change by 1%, the change in the value

-

[单选题]For a 10-year floating-rate security, if market interest rates change by 1%

- 查看答案

-

A 10-year bond is issued on January 1, 2010. Its contract requires that its coupon rate change over

-

[单选题]A 10-year bond is issued on January 1, 2010. Its contract requires that its

- 查看答案

-

The 4-year spot rate is 9.45%, and the 3-year spot rate is 9.85%. What is the 1-year forward rate th

-

[单选题]The 4-year spot rate is 9.45%, and the 3-year spot rate is 9.85%. What is t

- 查看答案

-

Consider a $1 million semiannual-pay, floating-rate issue where the rate is reset on January 1 and J

-

[单选题]Consider a $1 million semiannual-pay, floating-rate issue where the rate is

- 查看答案

-

A floating-rate security will have the greatest duration:

-

[单选题]A floating-rate security will have the greatest duration:A.The day before t

- 查看答案

-

All else being equal, the ceiling on a floating-rate security is most likely to benefit the:

-

[单选题]All else being equal, the ceiling on a floating-rate security is most likel

- 查看答案

-

A floating-rate security is most likely to trade at a discount to its par value because the:

-

[单选题]A floating-rate security is most likely to trade at a discount to its par v

- 查看答案

-

Which of the following 5-year bonds has the highest interest rate risk?

-

[单选题]Which of the following 5-year bonds has the highest interest rate risk?A.A

- 查看答案

-

An inverse floating-rate bond:

-

[单选题]An inverse floating-rate bond:A.may,under certain circumstances,require the

- 查看答案